This is part seven of a blog series on The Nine Environments of You — a powerful coaching model designed to create balance in your life. Today’s post explores the power of tending to your Financial environment. You can read more about the Nine Environments model by visiting my previous blog post here.

Do you know your numbers?

Nearly anything you do will be affected by your financial situation. How is your financial health? If you don’t know, it may be time to pull your head out of the sand and take an honest look at your current reality — including your income, expenses, investments, and budget. Far too many people have lived on easy-to-get credit and have dug a deep hole because they weren’t paying attention.

Nearly anything you do will be affected by your financial situation. How is your financial health? If you don’t know, it may be time to pull your head out of the sand and take an honest look at your current reality — including your income, expenses, investments, and budget. Far too many people have lived on easy-to-get credit and have dug a deep hole because they weren’t paying attention.

I believe in transparency, so I’ll begin by confessing that I don’t enjoy tending to this part of my life, or anything that involves numbers. It’s just not my thing! That being said, I recognize the importance of tending to my financial health, so I pay attention to the extent that I need to. I also seek my husband’s assistance and have also hired trusted professionals to help me with financial matters I am not good at doing or don’t enjoy.

The key here is to find trusted professionals. Get references and fully check them out before you hire someone. Once you hire someone, you still need to be involved and aware of everything that’s going on, ensuring that your wishes are being honored in all financial matters. Over the years, I have worked with a bookkeeper to manage all of my business finances, a CPA for both my business and personal tax returns, a wealth management advisor, and an estate planning attorney.

Although you need to understand the facts about your current financial situation, it’s also vital that you visualize the future you desire. What thoughts, habits, and actions are required to move you in the direction you want to go with your life?

One huge influence over your Financial environment is your Memetics (environment #1 of the Nine Environments model). How often do you say to yourself, “I can’t afford it”? That may be a motif in your life that has become a self-fulfilling prophecy.

One huge influence over your Financial environment is your Memetics (environment #1 of the Nine Environments model). How often do you say to yourself, “I can’t afford it”? That may be a motif in your life that has become a self-fulfilling prophecy.

In Secrets of the Millionaire Mind, T. Harv Eker notes that each person possesses a “money blueprint” — an internal script for dealing with money — that comprises the lessons we learned in childhood. Most of us have carried those blueprints into adulthood. This is what keeps some people stuck at a certain income level. Their money blueprint is set low. This is also what enables Donald Trump to lose millions of dollars and then earn it right back. His money blueprint is set very high. If you’d like to better understand and enhance your own beliefs about money, check out my guide, What Does Your Money Blueprint Say About You?

Will Smith — famous actor, producer, and multimillionaire — was asked by Oprah, “How does it feel to be rich?” His answer may surprise you! He confided that at the end of the day, he doesn’t feel rich. He still feels poor! Will Smith cannot shake the way he felt growing up — poor and always struggling for money. He routinely gets anxious and fearful that he’s going to lose everything. Will’s dad taught him to always work hard. As a result, he has a tremendous work ethic, but he never learned how to feel abundance in his life. Even with all his success and wealth, his mind perpetuates an internal state of “not enough.” His money blueprint is set to “poor and struggling.”

Are you saving for retirement?

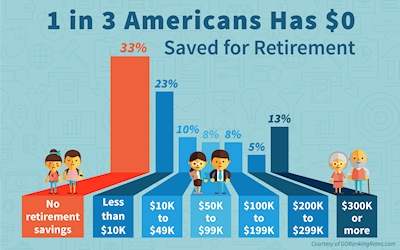

Did you know that one in every three Americans has nothing saved for retirement?

Did you know that one in every three Americans has nothing saved for retirement?

I think of money as an exchange of energy…since energy is required to generate products or services that are sold or bartered. When you reach retirement age, your energy will most likely not be available at the same level it was when you were young and just beginning your work life. If you want to maintain your standard of living into your retirement years, you must plan ahead.

Money management expert Jean Chatzky offers these interesting budget factors to consider:

- Because of the increase in diabetes, obesity, and other chronic diseases among people in their 40s and 50s, there’s a greater chance that older parents will not only outlive their kids but will also be called upon to physically and financially care for them. (Click here to read my blog about the Body environment.)

- The cost of raising children is much higher than it used to be. Middle-income parents average $37,000 per child on child care and school costs before that child heads off to college. In 1960, this amount was only $4000 per child (in today’s dollars).

- Low-income families spend about 41% of their budget on housing, where high-income families spend closer to 30%.

A good financial guide is to have the equivalent of your annual salary saved and invested by age 30 and to have 10 times your final salary invested in savings so you can comfortably retire by the age of 67. While this sounds daunting, if you begin putting your money to work starting in your twenties, the combined effect of compound interest and all those years of savings makes it possible even for someone earning minimum wage to have saved over $1 million by the age of retirement.

I often hear people say that they want to save more, but they just cannot afford to. My response…you can’t afford NOT to save now for your future!

You work hard to earn your money. Unfortunately, it’s far too easy to mindlessly spend and waste it, whether it’s paying a late fee or blowing your budget on impulse shopping.

A good habit to develop – starting today — is to take a more mindful approach to spending so you can afford to set some earned income aside, and to have a solid plan in place for saving monthly so you can live comfortably when you retire. I’ve compiled a list of 101 Ways to Save Money to help.

Hire a Professional

As you change your money blueprint and learn how to allow the flow of money into your life, you may benefit from gaining some expertise on how to leverage the money you have by making wise investments. I encourage you to seek the advice of a trusted professional.

As you change your money blueprint and learn how to allow the flow of money into your life, you may benefit from gaining some expertise on how to leverage the money you have by making wise investments. I encourage you to seek the advice of a trusted professional.

According to Financial Industry Regulatory Authority (FINRA), there are 184 financial designations. Some are extremely hard to obtain, while others can be obtained by simply paying a fee. If you work with a financial advisor that does not have one of the following designations, you have no way to adequately judge their competency as an advisor:

- A Certified Financial Planner (CFP) must have a 4-year college degree, complete the required coursework prescribed by the CFP Board, pass a comprehensive 6-hour test, have three years of experience, abide by the CFP® code of ethics and maintain continuing education requirements. One of the hallmarks of a CFP is that they have a fiduciary responsibility when working on financial planning, which means they have to act in their clients’ best interest. They are required to go through rigorous education and examination and adhere to a high standard of ethics. These planners are certified to advise on everything from taxes to insurance to estate planning and are required to complete ongoing continued education requirements.

- A Chartered Financial Analyst (CFA) is a professional designation awarded by the CFA Institute. Candidates are required to pass three levels of examination covering areas such as accounting, economics, ethics, money management, and security analysis. This may be the designation that you’re looking for if you just want help with investments.

- A Chartered Life Underwriter (CLU) is a professional designation awarded by The American College of Financial Services for individuals who wish to specialize in life insurance and estate planning. It represents a thorough understanding of a broad array of personal risk management and life insurance planning issues. Look for this designation if you are looking for help with personal insurance.

- A Chartered Financial Consultant (ChFC) designation was designed by The American College of Financial Services primarily for insurance sales people to compete with the CFP designation. The ChFC has no final test requirement or an ethics component.

- A Personal Financial Specialist (PFS) is only available for those who are a CPA. This designation requires much less education than the above designations and relies mostly on work experience in the financial planning field. Look for the PFS if you’re primarily looking for help with taxes.

- An Investment Broker brings together buyers and sellers of investments. They are required to be licensed to act on behalf of buyers and sellers of stock. They charge a commission on trades that they execute based on the instructions they receive from buyers and sellers.

- An Estate Planning Attorney specializes in legal aspects of managing your estate, whichis comprised of everything you own — your car, home, other real estate, checking and savings accounts, investments, life insurance, furniture, personal possessions. An Estate Planning Attorney helps you to create a written plan that stipulates who will receive the things you own after you die, sometimes in the form of a trust or will. Planning ahead can give you greater control, privacy, and security of your legacy and can have a significant impact on estate taxes. An estate plan is part of your long-range financial planning.

There are many other designations but the above provide a meaningful role for various aspects of your financial planning. Other designations can be very specific to just investing or mutual funds or retirement, but your advisor should have broad knowledge, experience and be committed to ethical treatment of clients.

Forms of Compensation for Advisors

Be cautious if you are working with someone who makes recommendations based on what kind of commissions they will earn off your investment transactions. Consider working with someone who charges a flat fee for their services and does not gain or lose income based on your investment decisions. Here are the three ways that professionals are compensated:

Be cautious if you are working with someone who makes recommendations based on what kind of commissions they will earn off your investment transactions. Consider working with someone who charges a flat fee for their services and does not gain or lose income based on your investment decisions. Here are the three ways that professionals are compensated:

- Fee-only is the method that Registered Investment Advisors utilize. They are only paid directly from their client and the fee is known ahead of time. The fee may be by the hour, by the project, a fixed fee (sometimes referred to as a retainer fee), a percentage of assets that the advisor manages for the client or could be a combination of these options. Less than 5% of all financial advisors are fee-only.

- Commissions were how advisors and their firms were first paid years ago. Many are still paid this way. There’s always a potential conflict of interest with this approach, as the sales person may recommend one product over another due to the commissions that they and their firm will earn – regardless of what’s best for you.

- Fee based is often referred to as the hybrid methodology, whereby the advisor can both collect fees and commissions. About 84% of active SEC registered investment advisors are also dually registered with FINRA as representatives of a broker dealer. Another 10% – 12% of registered investment advisors are licensed to sell insurance. Most advisors at major broker dealers – like Morgan Stanley, Merrill Lynch, Edward Jones and JPMorgan/Citi – are hybrid advisors.

Please note that while some advisors are employees and may be paid a salary with or without bonuses, their employers are compensated by one of the prior three methodologies.

Just Do It!

Even if you don’t have much money to work with, start small and build from there. Remember that the combined effect of compound interest and many years of savings can add up to a sizeable retirement account that you’ll appreciate having when you are no longer working.

Below are some questions to help you get clear about what you are tolerating in your Financial environment:

Do my finances allow me to be at choice in my life, or are my decisions controlled by money?

Do my finances allow me to be at choice in my life, or are my decisions controlled by money?- Will I be able to retire when I want and choose to?

- Do I have any credit card debt? If so, do I have a plan for eliminating it?

- Do I work within a budget? Am I a good manager of my finances?

- Do I know the “bottom line” of my finances at any given time?

- Do I have a good credit score?

- Does money flow freely into my life? Do I have a high or low money blueprint?

- Have I leveraged my money through smart investments?

- Am I working with competent and trusted financial advisors, CPAs, and other financial professionals I need to help me with important financial management, decisions, and actions I need to take?

- Do I have adequate coverage for medical, auto, home, life, and disability insurance?

Once you’ve answered the questions above, you may have greater clarity about what needs some attention in your Financial environment. I encourage you to identify some “upgrades” you desire, as well as specific actions you will take, and by when.

Here’s an example of what that looks like:

Upgrades desired in the Financial environment:

- Assess my financial health.

- Upgrade my Money Blueprint.

- Identify ways to save money.

Actions to be taken by when:

- Identify all assets by (date).

- Identify all debt by (date).

- Find out my existing credit score by (date).

- Create a realistic budget by (date).

- Read 101 Ways to Save Money on Saturday and select 3-5 ideas to implement.

- Read What Does Your Money Blueprint Say About You? and identify what needs to shift in my views about money to foster a healthier relationship with money in my life.

Now, it’s your turn to identify the upgrades you desire, the actions you will take, and by when. I encourage you to choose ONE thing you will do to upgrade your Financial environment and commit to spending 15 minutes to take immediate action. As you do this with each environment, get ready to experience synchronicity in your life like never before, as things fall into place.

If you’d like a fresh perspective– someone to help you design the balanced life you want by aligning your vision, priorities, and actions—let’s schedule a no-cost, no-pressure Discovery Call today.

Additional Resources:

- Blog: Balance Your Life: The 9 Environments of You (overview)

- Blog: Balance Your Life: Environment #1 – Memetic/Mental

- Blog: Balance Your Life: Environment #2 – Body

- Blog: Balance Your Life: Environment #3 – Self

- Blog: Balance Your Life: Environment #5 – Relationships

- Blog: Balance Your Life: Environment #6 – Network

- Blog: 101 Ways to Save Money

- Blog: Are You Prepared? The time is NOW to get your affairs in order.

- Guide: What Does Your Money Blueprint Say About You?

Wonderful post. Greg and I are in the process of balancing our finances. I am going to be very aware of my language around our finances. Thank you Kathy!