Now that you’ve survived Tax Day, here’s a good question to ask: Do you have your financial records in order?

In my work to help clients declutter their life, I often discover that they’ve kept invoices and receipts for everything they’ve purchased or paid for over the last decade or more. When I ask how it will enhance their life to keep those things for that long, they often say, “Well, I don’t know how it will enhance my life. I’ve just been taught that I need to keep it!”

April is Records and Information Month…a good time to take inventory of how you maintain important records, including what to keep and for how long, and what to toss.

Before we get started with that, I’ll share something that is core to this work.

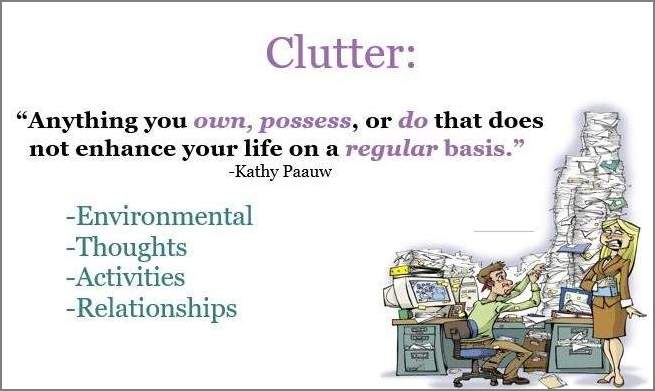

My Definition of Clutter:

Most people think of clutter as things in their physical environment. But clutter is not just physical stuff. It’s also old ideas, toxic relationships, and bad habits. In other words, it can show up in the form of thoughts, activities, and relationships that do not enhance your life.

Most people think of clutter as things in their physical environment. But clutter is not just physical stuff. It’s also old ideas, toxic relationships, and bad habits. In other words, it can show up in the form of thoughts, activities, and relationships that do not enhance your life.

If you’d like to drill down more to explore ways to handle all forms of clutter in your life, check out my blog on Hidden Clutter.

Keep or Toss?

Here is a list of questions I invite my clients to ask when deciding whether to keep or toss something:

Here is a list of questions I invite my clients to ask when deciding whether to keep or toss something:

- What’s the worst thing that could happen if I threw this away?

- If I threw this away now and discovered I needed it later, could I fairly easily replace it?

- By the time I might need this, will it be obsolete?

- If my office/home burned down, would I miss this item or information enough that I would actively seek to replace it?

- How will it enhance my life to keep this?

- Does it have tax or legal implications?

To answer this last question, you may want to do a Google search for file retention guidelines and see what the experts recommend. For example, most guidelines recommend that you keep your personal tax returns and supporting documents for seven years. After seven years, you can toss the supporting documents and it’s recommended that you keep your tax returns forever. Many people now file their tax returns electronically, so the copy they keep for their own records is an easy-to-store password-protected PDF document.

Please note that file and record retention guidelines are different for business than they are for personal.

For those who still deal with lots of paper, it often ends up in piles that grow on just about any horizontal surface available … including the floor and chairs. And if you think paper is going away anytime soon, here’s a humorous 39-second clip about paper…and the irony won’t be lost on you.

Why Do People Pile?

Over the last two decades I’ve asked hundreds of people what causes them to create piles. I’ve found there are two primary reasons:

- The number one reason is a fear of never finding something once it’s filed away. Piles of paper represent postponed decisions – the owner of the piles does not know where to store something or what to call it so they can find it later.

- The number two reason is a fear of forgetting to follow up on something that requires action. You may have a fear that if you put it away — out of sight, out of mind – you may forget to take the necessary action or you may not be able to find the support materials you need when you need them.

If you are a paper-piler and you relate to either or both of these fears, I’ll teach you a proven step-by-step process to help you overcome them. Participate in my free webinars and you’ll learn a simple process that will revolutionize your life.

- Buried in Paper teaches you an alternative to “I’ll just set that here for now.” You’ll learn how to make quick decisions about what to do with everything that comes into your life.

- Find Anything in 5 Seconds or Less introduces you to a system I have been using since 1996 that enables you to find anything you or others file or store in 5 seconds or less. Over all these years, it has not broken down over time like other systems I have tried.

If you struggle to “get your act together” with supportive systems and structures in place to help you manage day-to-day life, let’s schedule a no-cost discovery call. We’ll discuss the next steps you can take to organize your entire life–-so you can enjoy being focused and productive at work and be fully present with family and friends at home.

If you start working on this now, Tax Day won’t be nearly as painful next year!

Additional Resources:

- Blog: Are You Prepared?

- Blog: Hidden Clutter

- Guide: Organize Your Home: A Road Map to Getting Your Home in Order in Just 30 Days!

- Free Webinar: Buried in Paper

- Free Webinar: Find Anything in 5 Seconds or Less

Dear Kathy, I know from long time ago that you are a real expert in this….I have seen beautiful examples of your work on this issue….Anyway I really like your ideas and find them very helpful….Thank you for your ongoing support and help with all of us….

My pleasure, Sheida. Making simple decisions NOW can prevent a lot of stress down the road. I hope the questions I provided will help you in making good decisions about what to keep and what to toss.